Hey folks,

If you’ve been following my work, you know I regularly explore the philosophy of money, the structure of financial markets, and the institutions that shape our economy. Occasionally, I like to stress-test the future with original models—not to make predictions, but to explore possibilities.

This is one of those times.

Let me take you into a world where a 27-year-old in 2030 manages anxiety, skincare, birth control, and hair loss—all through one platform. No waiting rooms. No pharmacy lines. Just tap and go.

That world already exists in prototype form—and Hims & Hers (NASDAQ: HIMS) is trying to own it. This post is a story about what happens if they succeed.

The Backstory

After conversations in a few of my investment groups about $HIMS, I built a long-term financial model around a focused question:

What if Hims becomes the default pharmaceutical provider for Gen Z and millennials in the U.S.?

Not the whole population. Just the digitally native generations that increasingly treat healthcare like any other online subscription: convenient, discreet, and user-friendly. The model runs through 2050 and paints a provocative picture—one that’s intentionally aggressive but grounded in behavioral trends and economic logic.

A Generational Opportunity

Millennials and Gen Z aren’t just open to digital health—they were shaped by it.

They grew up booking everything online. Their relationships with brands are built on design, trust, and immediacy. They already manage banking, dating, therapy, workouts, and groceries via apps—and now, increasingly, their healthcare too.

When Gen X or Boomers needed a prescription, they went to CVS or Walgreens. It was a ritual. For many, it still is. But for digital natives, Hims is quietly becoming the default for first-line treatments. Whether it's anxiety meds, birth control, hair loss solutions, or acne treatments, they’re learning—often in their twenties—to go to Hims first.

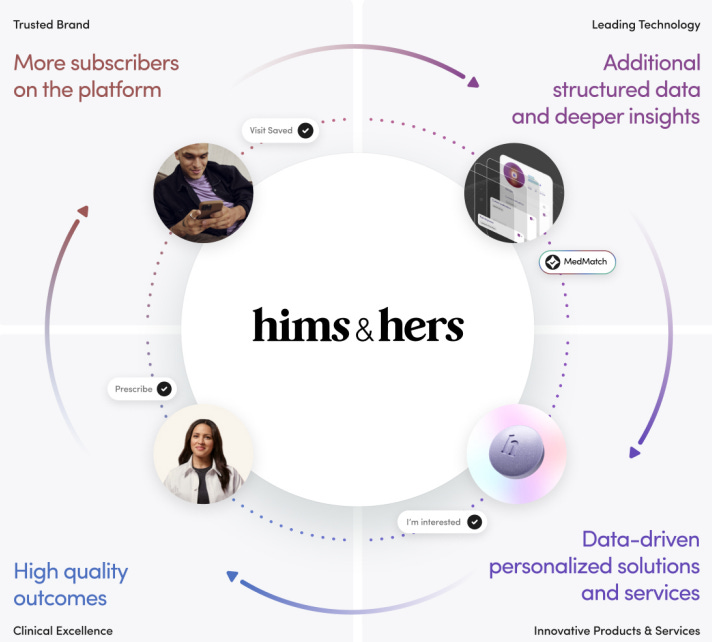

That habit—formed early—tends to harden over time. People don’t shop around for healthcare once they’ve found something that’s easy, discreet, and affordable. Hims is positioning itself to become the primary pharmaceutical relationship for tens of millions of Americans as they age.

Fast forward 10 to 20 years:

Millennials are in their 40s and 50s. Gen Z is entering middle age. This is when pharmaceutical demand inflects upward—just as it did for boomers. But unlike boomers, they won’t be browsing a pharmacy aisle. They’ll be tapping an app.

The average order value (AOV) for Hims today is modest—driven by a handful of high-frequency, relatively low-cost medications. But over time, AOV could expand dramatically as health needs grow more complex with age.

And crucially: this happens just as a wave of blockbuster drugs consumed by boomers today go off patent. As these medications become generics, Hims doesn’t have to invent anything. It simply needs to stock them, package them with care, and offer them to a base of loyal, aging customers already trained to come to them first.

This is the long game:

Habituation formed in youth.

Data for perpetual targeting.

AOV expansion through aging and upsell.

Generics unlocked by the patent cliff.

Brand-led distribution to a trust-based subscriber base.

That’s a real moat—if they can maintain it.

A Peek at the Model

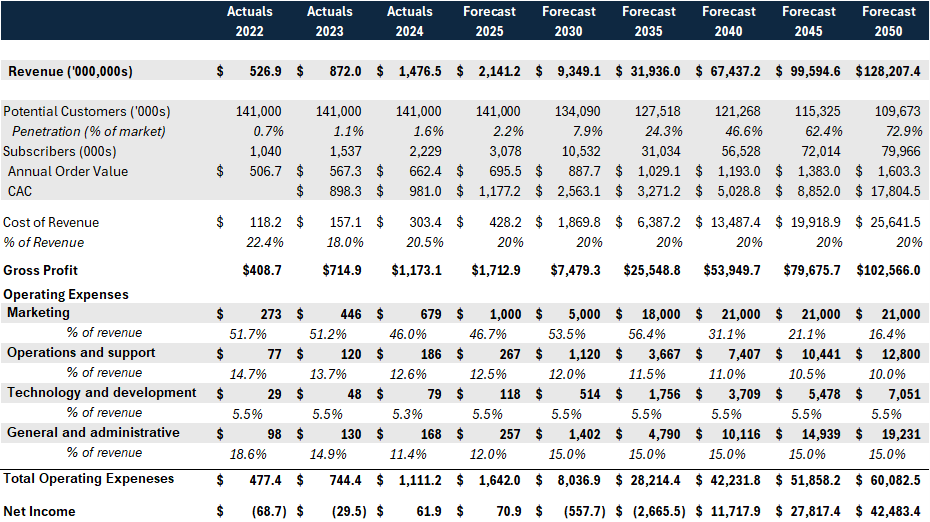

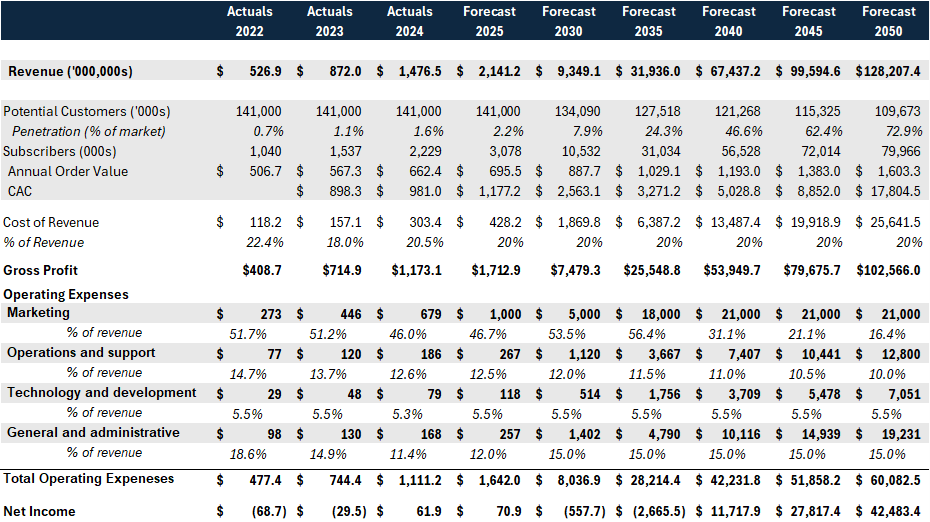

Here are a few high-level outputs from the model I built:

Revenue grows from $872M in 2023 → $128B in 2050

Subscribers increase from 1.5M to 80M

Market penetration hits 72.9% of Gen Z + Millennials

CAC rises from $980 → $17,800, reflecting tougher acquisition over time

2050 Share price modeled to reach $1,900.11 at a 10x P/E, implying a 15.2% CAGR

It’s ambitious—but not implausible, especially if Hims keeps expanding AOV, acquires competition, and captures the generation’s trust. Even if you assume this level of customer penetration is too bullish, with the model’s fairly low AOV expansion, you could make trade offs between market penetration and expanding AOV to reach a similar result.