No More Cushion: The New Reality for Borrowing Costs

Executive Summary

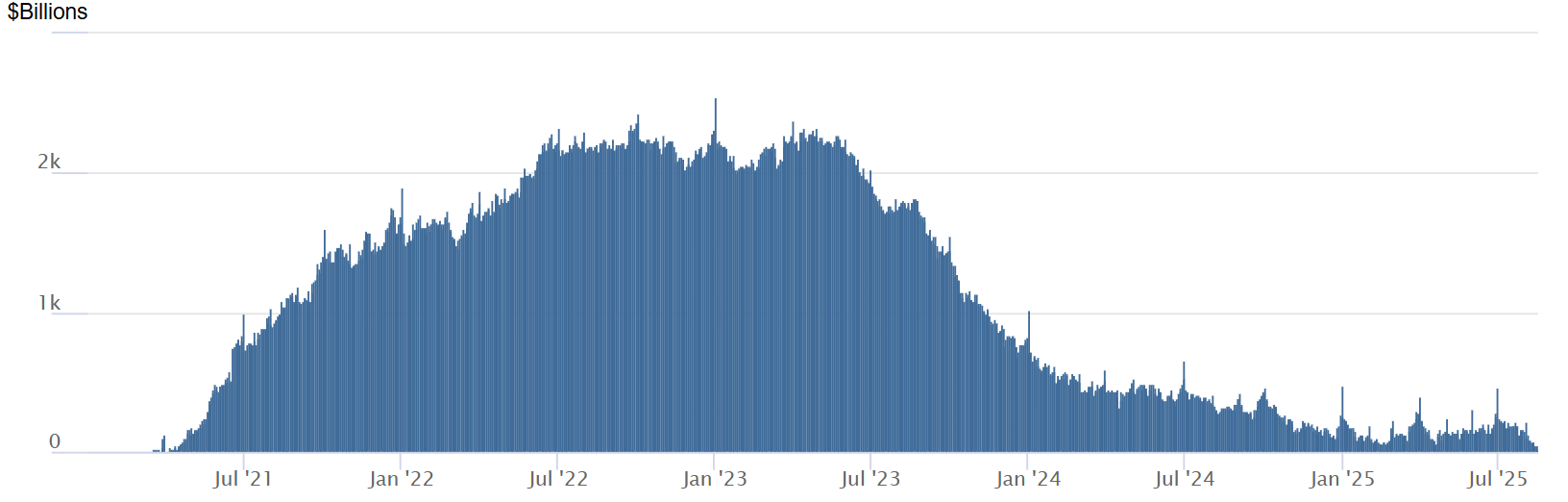

The Fed’s $2T “liquidity sponge” is gone, leaving no buffer between market stress and your bank’s cost of funds.

When liquidity is tight, Fed rate cuts may take months (not days) to lower SMB loan rates.

Market rates like SOFR can stay above target even after cuts, keeping borrowing costs elevated.

Expect credit pricing to be driven more by policy moves than by lender competition.

Plan financing with buffers: lock favorable terms when you can, and stress-test for slower-than-expected relief.

The Fed Metric That Signals Tighter Credit Ahead

Federal Reserve - Reverse Repo Operations [Source]

Most small business owners do not realize the Federal Reserve runs what is basically the safest overnight bank account in the world for big financial institutions. This program, called the overnight reverse repo facility, has been absorbing trillions of dollars of extra cash in the financial system since the pandemic.

Think of it like a giant sponge. When there was too much money sloshing around, the Fed soaked some of it up to keep short-term interest rates from falling too low. That “excess cash” acted as a buffer. If money was needed somewhere else, it could flow out of the facility back into the market without disrupting borrowing costs.

Today, that sponge is almost bone dry. The amount parked at the Fed has fallen from more than $2 trillion to nearly zero. That means there is no longer a reserve of extra cash to absorb shocks. From here, any strain in the financial system affects bank reserves directly. That matters to you because reserves are the foundation of how your bank decides how much to lend, and at what rate. If your bank’s reserves get squeezed, the rate they charge you to borrow can jump even if the Fed hasn’t changed its official rate.

If reserves get tight, short-term interest rates can move up quickly, which can affect the pricing of your credit line, equipment loan, or refinancing—sometimes in a matter of days.

How the “money plumbing” works for your business

Banks, money market funds, and large institutions lend each other money overnight to keep the financial system running smoothly. The Federal Reserve sets the floor for those overnight rates, which becomes the foundation for nearly all other short-term borrowing costs in the economy.

When there is extra cash in the system, these rates stay pinned near that floor. This means your bank can borrow cheaply, which helps keep the rates on your working capital lines, term loans, and equipment financing lower.

Secure Overnight Financing Rate - 2021 to 2025.

When cash is tight, it is a different story. Banks and other borrowers compete harder for available funds, driving rates higher above that Fed-set floor. Even if the Fed’s policy rate has not changed, your cost of borrowing can still rise because the “wholesale” price of money has gone up in the background.

Understanding this connection is important. If you notice short-term rates climbing while the Fed’s official rate is steady, it can be a sign that liquidity is tightening. That often shows up in business lending costs before it makes headlines. By the time you read about “tight liquidity” in the news, it may already be reflected in your loan quote or your next credit line renewal.

Why lower Fed rates do not always mean cheaper business loans

It is easy to assume that when the Federal Reserve cuts interest rates, borrowing costs will drop across the board. In reality, that is only true if there is enough cash in the financial system to keep market rates close to the Fed’s new lower floor.

When liquidity is plentiful, the cut flows through quickly. Your bank’s cost of funds drops, and that saving can be passed along to you in the form of lower rates on new loans or lower interest on variable-rate credit lines.

When liquidity is tight, lenders can keep charging more even after a Fed rate cut. That is because they are competing for a small pool of available cash, and those willing to pay more will get it first. In this environment, the Fed’s policy change is more of a signal than a guarantee. For the rate cut to truly reach your business, the Fed may need to step in and add cash to the system through what are called “repo operations,” which directly supply short-term funding to banks and dealers.

The takeaway for business owners is that Fed rate cuts are not an automatic trigger for lower borrowing costs. It is worth keeping an eye on short-term market rates like SOFR alongside the headlines, because they are the true day-to-day price of money. If you are counting on a Fed cut to reduce your financing costs, track these market rates so you can see whether the cut is actually flowing through — or if you need to wait before locking terms.

The 2019 wake-up call

In September 2019, the financial system hit a wall. Extra cash in the Fed’s reverse repo facility had already run down to zero, and reserves in the banking system were near the minimum needed to keep everything functioning smoothly. Then two things happened at the same time: large corporate tax payments pulled tens of billions out of bank accounts, and a big batch of newly issued Treasury bonds had to be paid for.

Those cash drains left banks and dealers scrambling for overnight funding. The cost of borrowing in the repo market, which is the backbone of short-term lending, jumped from about 2 percent to over 10 percent in a single day. SOFR, the main benchmark for short-term loans, spiked well above the Fed’s target range.

SOFR - September 2019, Liquidity dried up.

The Fed stepped in the next morning with emergency repo operations, lending cash directly into the market in exchange for Treasuries. Rates came back down quickly, but the episode forced the Fed to halt its balance sheet reduction earlier than planned.

For business owners, this is a reminder that funding stress can appear suddenly and feed into higher borrowing costs almost immediately. Even if you are not borrowing in overnight markets, your lender’s cost of funds can shift in a matter of hours when the cushion is gone.

The 2025 setup

With the Fed’s reverse repo facility nearly empty, there is no longer a pool of excess cash that can buffer the system from short-term funding pressures. This means we are entering a stage where the effects of Fed policy changes, like interest rate cuts, may play out differently than many expect.

Overnight Reverse Repo Operations from the Federal Reserve - August 2025

In a well-cushioned system, a Fed rate cut usually pulls market rates down quickly, which in turn helps lower borrowing costs for businesses and consumers. Without that cushion, a rate cut may not bring market rates down as far or as fast, because competition for limited cash can keep short-term lending rates elevated.

For inflation, this dynamic cuts both ways. If market rates stay higher than the Fed intends, credit conditions can remain tighter, which slows economic activity. But if the Fed responds by adding liquidity to push rates down, it can also ease financial conditions faster, which may help growth but risks fueling inflation if done too aggressively.

For borrowers, the main takeaway is that future Fed rate cuts may not translate to immediate relief on borrowing costs, especially in the early stages of an easing cycle. Understanding this lag can help with planning around refinancing or taking on new debt.

Why the Fed’s balance sheet still matters for your next loan

The Federal Reserve’s balance sheet has been shrinking for the past two years, but the “excess cash” portion is now gone. Any further reduction would come straight out of the reserves that banks rely on to settle payments and meet regulatory requirements. If those reserves drop too far, short-term funding markets can get unstable, which forces the Fed to step in and add liquidity back.

Federal Reserve Assets since 2015 (in Millions [ i.e. 7M = 7 Trillion] )

For you, the important part is this: because the Fed is near that lower limit, it is unlikely to tighten much further through balance sheet reductions. That means the main lever left to control inflation is interest rate policy. If inflation runs hotter than expected, the Fed will lean on keeping rates higher for longer, which directly affects your borrowing costs.

Even when rates do come down, banks will still be earning a safe, policy-set return on the reserves they hold at the Fed. That means they will not chase every lending opportunity just to put cash to work. They will remain selective, and spreads may not narrow quickly after the first rate cuts.

What this means for your business:

Do not expect big drops in loan rates purely because the Fed’s balance sheet is shrinking — that phase of tightening is nearly done.

Rate cuts, when they happen, may take time to filter into better loan terms.

If you are planning to refinance or borrow, keep an eye on Fed policy announcements, not just market chatter.

The new dependency

Over the past decade, the financial system has grown used to the Federal Reserve acting as a standing backstop for liquidity. Banks, money market funds, and large borrowers know that if short-term funding markets become stressed, the Fed can quickly add cash through its lending facilities.

For businesses, this setup is mostly invisible — until it is not. In normal times, it helps keep credit markets stable and prevents sudden spikes in borrowing costs. But it also means that when the Fed misjudges how much cash is in the system or keeps rates too high or too low for too long, the effects ripple quickly through to loan pricing, credit availability, and investor confidence.

This dependency has a trade-off. Stability is higher most of the time, but market discipline is weaker. Instead of rates and credit terms moving primarily based on supply and demand between lenders and borrowers, they are anchored to the Fed’s policy decisions. When policy is well-calibrated, this is good for predictability. When it is not, the whole system moves in the wrong direction together.

For your business, the takeaway is that the Fed is now one of the largest forces shaping credit costs, alongside lender competition, risk appetite, and your own financial profile. Market conditions still matter, but policy shifts can move borrowing costs faster than you might expect, so it pays to track both.

The philosophical shift

The U.S. credit system has changed. A generation ago, the base cost of money was shaped mostly by market forces. Today, it is anchored by policy. The Federal Reserve’s balance sheet, interest rate decisions, and the Treasury’s issuance plans now set the starting point for nearly every loan and credit line in the economy. Markets still decide the spread you pay on top of that base rate, but the floor is determined elsewhere.

For a disciplined business owner, this matters less as a debate and more as a planning reality. Rate shifts are now more likely to come from a policy announcement than from a sudden surge or drop in market competition. Sometimes those moves will pass through to your borrowing costs quickly, other times they will take months. Neither outcome is fully in your control.

What you can control is your positioning. Keep financing flexible enough to benefit from favorable moves, but resilient enough to handle delays or reversals. Watch the policy calendar and the broader economy together, and make funding decisions on your own schedule — not in reaction to the noise around every rate headline.

Running your business in a policy-shaped credit world

The Fed’s liquidity cushion is gone, reserves are closer to their floor, and short-term rates are now more sensitive to policy decisions than they have been in years. That is the backdrop you are operating in. You cannot change it, but you can factor it into how you approach financing.

For most small and medium businesses, this means two things. First, watch policy as closely as you watch market conditions. If the Fed signals a shift, know how it might filter into your borrowing costs and have a plan to act when the change reaches your lender. Second, build your capital structure so you are not dependent on perfect timing. That might mean locking in terms when conditions are favorable, or keeping flexibility to adjust if rates move against you.

Here are a few practical examples to make this real:

If you are due to refinance an equipment loan in six months and the Fed has just signaled a possible cut, weigh whether to bridge with short-term financing so you can capture a lower rate later — but model the risk if the cut is delayed.

If you are sitting on a large variable-rate credit line that has become expensive, compare the cost of paying it down now versus restructuring part of it into a fixed-rate term loan while policy rates are stable.

If you have a major capital project planned, stress-test it at both current rates and at rates 100 basis points higher, so you are not forced into a bad financing deal if liquidity tightens unexpectedly.

The credit environment will keep evolving, and policy will continue to play a larger role in shaping it. The businesses that thrive are the ones that treat these shifts as inputs to their own decisions — not as reasons to delay them.

If you want to make sure your financing plans work in this new, policy-shaped credit environment, it helps to have a partner tracking both the market and the Fed. At Saorsa Growth Partners, we work with business owners to translate these shifts into clear, actionable funding strategies, so you can move when the timing is right and stay resilient when it’s not.